The banking industry is undergoing a major transformation as customers demand more personalised and convenient services. Fintechs, or financial technology companies, are emerging as key players in this changing landscape, offering innovative solutions that cater to the needs and preferences of the digital-savvy consumers.

However, fintechs are not only competitors, but also potential partners for banks. According to a recent report by Temenos, a leading banking software provider, banks must harness disruptive technologies or actively participate in digital ecosystems to ensure customer retention and loyalty.

The Rise of Fintechs and the Challenges for Banks

Fintechs are leveraging technologies such as artificial intelligence, cloud computing, blockchain, and biometrics to offer a range of financial services, such as payments, lending, wealth management, insurance, and remittances. These services are often faster, cheaper, and more user-friendly than the traditional ones offered by banks.

Fintechs are also tapping into the unbanked and underbanked segments of the population, providing them with access to financial inclusion and empowerment. According to the World Bank, there are about 1.7 billion adults globally who do not have an account at a financial institution or a mobile money provider.

Fintechs pose a significant threat to the incumbent banks, as they can erode their market share, revenue, and profitability. A survey by PwC found that 88% of financial institutions globally are worried about losing business to fintechs. Moreover, fintechs can also challenge the trust and reputation of banks, as they can offer more transparency and security to their customers.

The Benefits of Collaboration between Banks and Fintechs

However, fintechs are not only enemies, but also allies for banks. By collaborating with fintechs, banks can leverage their strengths and overcome their weaknesses. Some of the benefits of collaboration are:

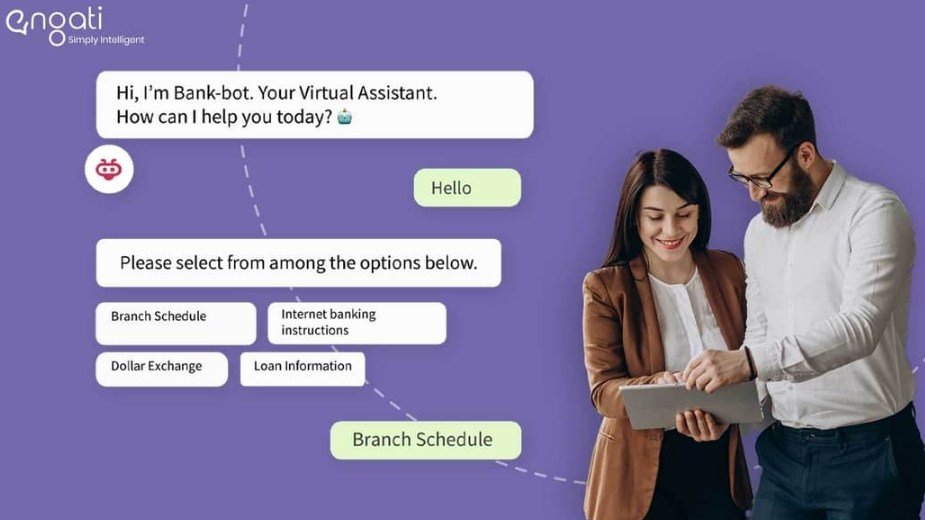

- Enhanced customer experience: By partnering with fintechs, banks can offer more personalised and convenient services to their customers, such as instant payments, robo-advisory, biometric authentication, and chatbots. This can improve customer satisfaction and loyalty, as well as attract new customers.

- Reduced costs and risks: By adopting fintech solutions, banks can reduce their operational costs and risks, such as fraud prevention, compliance management, data security, and infrastructure maintenance. This can improve their efficiency and profitability.

- Increased innovation and agility: By working with fintechs, banks can access new technologies and capabilities that can help them innovate and adapt to the changing market conditions and customer expectations. This can enhance their competitiveness and resilience.

- Expanded market reach: By joining forces with fintechs, banks can access new segments and geographies that they may not be able to serve otherwise. This can increase their customer base and revenue potential.

The Key Factors for Successful Collaboration between Banks and Fintechs

Collaboration between banks and fintechs is not easy, as it involves various challenges and barriers, such as regulatory uncertainty, cultural differences, technical compatibility, data privacy, and trust issues. Therefore, both parties need to consider some key factors for successful collaboration:

- Clear vision and strategy: Both banks and fintechs need to have a clear vision and strategy for their collaboration, defining their goals, expectations, roles, responsibilities, benefits, and risks. They also need to align their values and cultures to ensure a smooth cooperation.

- Open communication and transparency: Both banks and fintechs need to communicate openly and transparently with each other throughout the collaboration process. They need to share information, feedback, ideas, concerns, and solutions in a timely and respectful manner. They also need to establish trust and rapport with each other.

- Flexible governance and regulation: Both banks and fintechs need to comply with the relevant laws and regulations in their respective jurisdictions. However, they also need to be flexible and adaptable to the evolving regulatory environment. They need to work together with the regulators to ensure that their collaboration is compliant and beneficial for all stakeholders.

- Scalable technology and infrastructure: Both banks and fintechs need to have scalable technology and infrastructure that can support their collaboration. They need to ensure that their systems are compatible, interoperable, secure, reliable, and efficient. They also need to invest in innovation and development to keep up with the technological advancements.

The banking industry is facing a significant disruption from the fintech sector. However, instead of competing with each other, banks and fintechs can collaborate with each other to create a win-win situation for themselves and their customers. By harnessing disruptive technologies or participating in digital ecosystems, banks can enhance their customer experience, reduce their costs and risks, increase their innovation and agility, and expand their market reach.