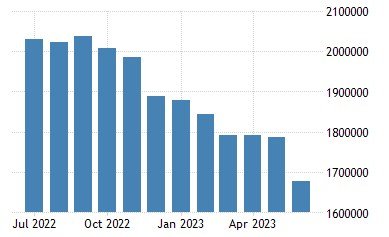

France’s banks balance sheet decreased by 2.2% in June 2023

According to the latest data from Banque de France, the balance sheet of France’s banks decreased by 2.2% in June 2023, reaching 11.75 trillion euros. This is the lowest level since December 2022, when the balance sheet stood at 11.72 trillion euros. The balance sheet of France’s banks reflects the total assets and liabilities of the banking sector, including loans, deposits, securities, and other items.

The decrease in the balance sheet of France’s banks in June 2023 was mainly driven by a decline in loans to the private sector, which fell by 0.3% to 3.06 trillion euros. This was the first monthly drop in loans to the private sector since April 2022, when the COVID-19 pandemic hit the economy hard. The decline in loans to the private sector in June 2023 was attributed to lower demand for credit from both households and non-financial corporations, as well as higher repayments.

Another factor that contributed to the decrease in the balance sheet of France’s banks in June 2023 was a reduction in securities held by banks, which fell by 1.9% to 4.32 trillion euros. This was mainly due to a decrease in holdings of debt securities issued by the French government and other euro area countries, as well as a decrease in holdings of equity and investment fund shares.

France’s banks balance sheet expected to rebound in August 2023

Despite the decrease in the balance sheet of France’s banks in June 2023, analysts expect a rebound in August 2023, based on the forecast from Trading Economics. Trading Economics projects that the balance sheet of France’s banks will increase by 1.6% in August 2023, reaching 11.95 trillion euros. This would be the highest level since May 2023, when the balance sheet reached a record high of 12.01 trillion euros.

The expected rebound in the balance sheet of France’s banks in August 2023 is based on several factors, such as:

- An improvement in the economic outlook for France and the euro area, as the vaccination campaign progresses and the COVID-19 restrictions are eased.

- An increase in loans to the private sector, as consumer and business confidence recovers and credit conditions remain favorable.

- An increase in securities held by banks, as bond yields remain low and stock markets rally.

France’s banks balance sheet compared to other countries

The balance sheet of France’s banks is one of the largest in the world, ranking fourth after China, Japan, and the United States. According to the data from Trading Economics, as of June 2023, the balance sheet of China’s banks was 45.67 trillion euros, followed by Japan’s banks with 16.64 trillion euros, and the United States’ banks with 15.86 trillion euros.

The balance sheet of France’s banks is also one of the largest in the euro area, accounting for about 23% of the total balance sheet of euro area banks. According to the data from Banque de France, as of June 2023, the balance sheet of euro area banks was 51.08 trillion euros, followed by Germany’s banks with 10.24 trillion euros, and Italy’s banks with 5.76 trillion euros.

The balance sheet of France’s banks reflects the size and importance of the French banking sector, which is one of the most diversified and competitive in Europe and globally. The French banking sector provides a wide range of financial services to households, businesses, and public entities, as well as playing a key role in financing the economy and supporting the recovery from the COVID-19 crisis.