The Federal Reserve slashed its benchmark interest rate by 25 basis points on September 17, 2025, marking the first cut of the year in response to a cooling labor market and rising unemployment. Chair Jerome Powell signaled that two more reductions could follow by year’s end, balancing persistent inflation concerns with the need to support job growth.

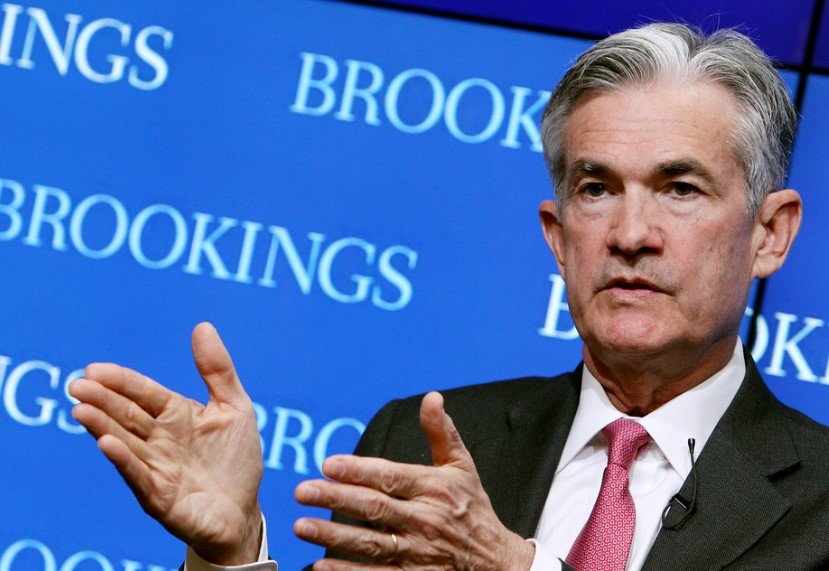

Powell Highlights Labor Market Risks

Jerome Powell stressed during his post-meeting press conference that the labor market has softened more than expected. He pointed to recent data showing job creation slowing to levels below what’s needed to keep unemployment steady.

Unemployment rose to 4.3 percent in August, with minority groups facing even higher rates. Powell noted that younger workers and those in cyclical industries are feeling the pinch first.

Businesses have cut back on hiring, and any uptick in layoffs could worsen the situation. The Fed aims to prevent a deeper slowdown by easing borrowing costs now.

This move comes after months of steady rates, as the central bank watched inflation hover above its 2 percent target.

Details of the Rate Cut

The Fed lowered its key rate to a range of 4.00 percent to 4.25 percent. This adjustment is the first since December 2024.

Only one dissenter, new Governor Stephen Miran, voted for a larger 50 basis point cut. The rest of the committee backed the quarter-point reduction.

Powell described the decision as a careful step in an uncertain environment. He said the Fed must juggle inflation risks while addressing employment goals.

The central bank also continues its quantitative tightening, reducing its balance sheet to normalize policy.

Updated Economic Projections

The Fed revised its forecasts, painting a picture of slower growth and stickier inflation ahead.

Key changes include:

- GDP growth for 2025 now expected at 1.4 percent, down from earlier estimates of 1.7 percent.

- Unemployment projected to reach 4.5 percent by year-end, up slightly from previous forecasts.

- PCE inflation seen at 3.0 percent, with core PCE at 3.1 percent, both higher than anticipated.

These updates reflect a “stagflation-lite” scenario, where growth stalls while prices remain elevated.

Here’s a quick table summarizing the Fed’s latest projections compared to prior ones:

| Metric | Previous Forecast (March 2025) | New Forecast (September 2025) |

|---|---|---|

| GDP Growth | 1.7% | 1.4% |

| Unemployment Rate | 4.4% | 4.5% |

| PCE Inflation | 2.7% | 3.0% |

| Core PCE Inflation | 2.8% | 3.1% |

| Federal Funds Rate | 4.00%-4.25% (current) | Two more cuts expected |

This table highlights the Fed’s growing caution about the economy.

Market Reactions and Broader Impacts

Stock markets showed mixed responses right after the announcement. The Dow Jones climbed about 0.5 percent, while the S&P 500 and Nasdaq dipped slightly.

Bond yields fell, and the dollar weakened against major currencies. Investors seem to price in a dovish Fed path.

Borrowing costs for consumers and businesses should ease, potentially boosting spending and investment. Homebuyers might see lower mortgage rates soon.

However, persistent inflation at 2.9 percent in recent months could limit how aggressive the Fed gets with further cuts.

President Trump’s ongoing criticism of the Fed for not cutting faster added political pressure, though Powell emphasized the bank’s independence.

Looking Ahead to More Cuts

Powell hinted at up to two additional rate reductions in 2025, likely at the October and December meetings. This would bring the benchmark rate down to around 3.75 percent.

He said downside risks to jobs have grown, while upside inflation risks have eased a bit. The Fed will monitor data closely.

Analysts expect the labor market to remain a key driver. If job growth picks up, cuts might pause; if it weakens further, more easing could come.

Recent events, like the slowdown in August job additions to just 22,000, underscore the urgency. Powell called the situation unusual, with inflation not falling as hoped amid labor cooling.

What do you think about the Fed’s move? Share your thoughts in the comments below and pass this article along to friends following economic news.