Elon Musk’s artificial intelligence venture xAI has closed one of the largest private funding rounds ever seen in the sector, pulling in $20 billion from a mix of strategic and financial backers led by Nvidia. The deal reshapes the balance of power in AI financing and signals how high the stakes have become.

A funding round months in the making finally comes together

xAI confirmed on Tuesday that it has completed a $20 billion funding round, capping months of quiet negotiations and market chatter.

The round includes participation from Nvidia, Valor Equity Partners, the Qatar Investment Authority, StepStone Group, Fidelity Management & Research, MGX, Baron Capital Group, and Cisco Systems’ investment arm.

For people tracking big-money tech deals, this one had been expected. Still, the final size surprised some, especially given the broader slowdown in late-stage venture funding.

According to earlier reporting by Bloomberg, the financing was structured as a blend of roughly $7.5 billion in equity and up to $12.5 billion in debt arranged through a special purpose vehicle. xAI did not confirm the precise breakdown, and it declined to disclose how much each investor contributed.

That lack of detail feels intentional.

In private markets right now, opacity is often part of the strategy, especially when valuations, debt terms, and long-term supply agreements are tied together behind closed doors.

Why Nvidia’s involvement matters more than the headline number

Nvidia’s presence in the round stands out, and not just because of the rumored $2 billion commitment discussed earlier by Bloomberg.

This is not a passive financial bet.

Nvidia controls the hardware backbone of modern AI systems, and its chips are the scarce resource every major AI lab is chasing. By backing xAI, Nvidia deepens a relationship that is as much about supply alignment as it is about returns.

For Musk, this matters. Big AI ambitions are easy to announce, harder to fund, and even harder to scale without guaranteed access to compute.

Industry executives say that partnerships like this can quietly influence who gets priority when chip supply tightens again. Nobody says that part out loud, but everyone in the room understands it.

There is also signaling value.

When Nvidia invests, other institutions pay attention. Pension funds, sovereign wealth funds, and asset managers often see Nvidia’s involvement as a form of technical validation, even if unofficial.

In that sense, Nvidia’s name on the cap table may be as valuable as the dollars themselves.

How xAI plans to spend $20 billion without blinking

In a statement announcing the financing, xAI said the new capital will speed up infrastructure expansion, support faster product development, and fund long-term research aligned with the company’s mission of “Understanding the Universe.”

That phrase has become a signature of Musk-led ventures. Some roll their eyes. Others see it as a recruiting tool.

Behind the lofty language, the spending priorities are fairly concrete.

People familiar with the company’s plans point to three main areas where the money is likely to go:

-

Massive data center capacity, including custom-built facilities optimized for large language models

-

Continued development of the Grok model family, including consumer-facing updates and enterprise integrations

-

Research staffing, particularly in systems design, model efficiency, and large-scale training methods

One sentence sums it up: compute, compute, and more compute.

AI labs at this level burn cash at a pace that would have seemed reckless just a few years ago. Training runs cost tens or even hundreds of millions of dollars. Power bills alone can rival the payroll of a mid-sized company.

That reality helps explain why debt was part of the structure. Equity alone would have been far more expensive.

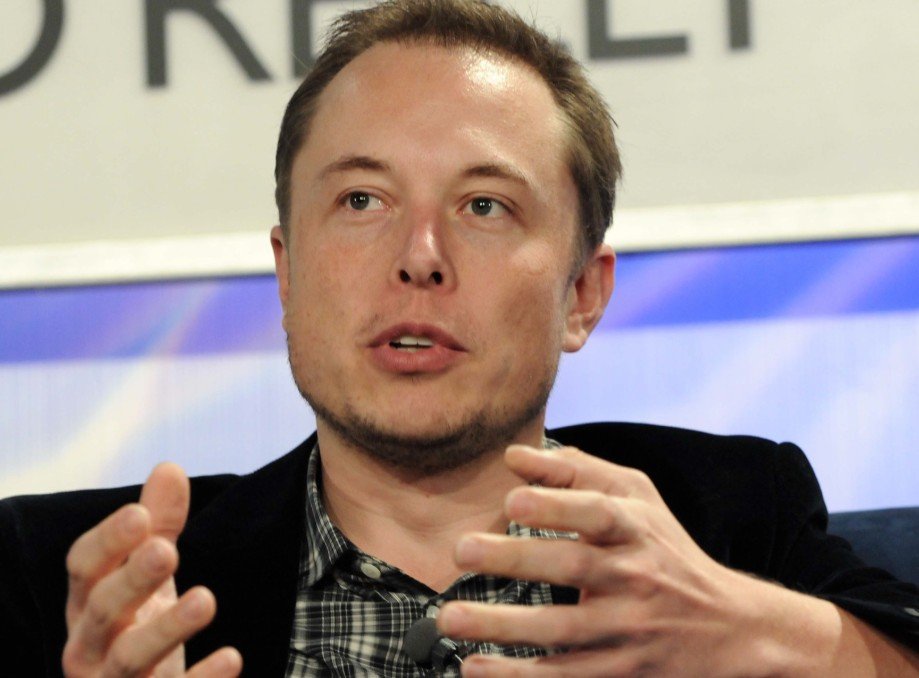

The Musk factor, for better or worse

Any story about xAI is also a story about Elon Musk.

Supporters see him as the rare founder who can attract capital at almost any scale, even when markets turn cautious. Critics argue that his growing list of commitments spreads focus thin and adds execution risk.

Both views coexist.

What is clear is that Musk’s personal brand still moves money. Sovereign funds, institutional investors, and strategic partners continue to line up when he calls, even after public controversies and shifting political positions.

For xAI, that cuts both ways.

The upside is obvious: fundraising at this level becomes possible. The downside is scrutiny. Every product delay, every model comparison, every public comment gets amplified.

Some investors are comfortable with that trade-off. Others are not. The composition of this round suggests xAI has found backers firmly in the first camp.

How this round changes the competitive map in AI

The $20 billion raise places xAI in a very small club.

Only a handful of private AI companies globally have secured funding at this scale, and most are closely tied to cloud giants or established platforms.

xAI is different. It is deeply linked to Musk’s broader ecosystem, including X, Tesla, and SpaceX, but it is not owned by a traditional cloud provider.

That independence gives it flexibility. It also increases pressure to build and operate infrastructure that others can outsource.

Industry analysts say this round narrows the gap between xAI and better-established rivals in terms of raw spending ability. It does not guarantee leadership, but it buys time, talent, and optionality.

One investor put it bluntly: in AI right now, survival itself is expensive.

Debt, dilution, and the quiet risks behind the headlines

The scale of the deal grabs attention, but the structure deserves just as much scrutiny.

Debt-heavy financings introduce fixed obligations into businesses that are still burning cash. If market conditions tighten or technical progress stalls, repayment terms can quickly become uncomfortable.

At the same time, limiting equity dilution preserves founder control and keeps upside concentrated.

That balance appears deliberate.

Special purpose vehicles, often used in infrastructure-heavy projects, can isolate risk and make the deal more palatable to conservative investors. They also add complexity that only a small group of financiers truly understands.

For now, markets are giving xAI the benefit of the doubt.

Whether that continues will depend on execution, adoption, and the pace at which AI systems translate into durable revenue streams.