RBA minutes awaited for rate clues

Australian shares slipped on Monday as losses in financials and technology stocks outweighed gains in commodity-related stocks, while investors awaited minutes of the central bank’s last policy meeting for interest rate clues.

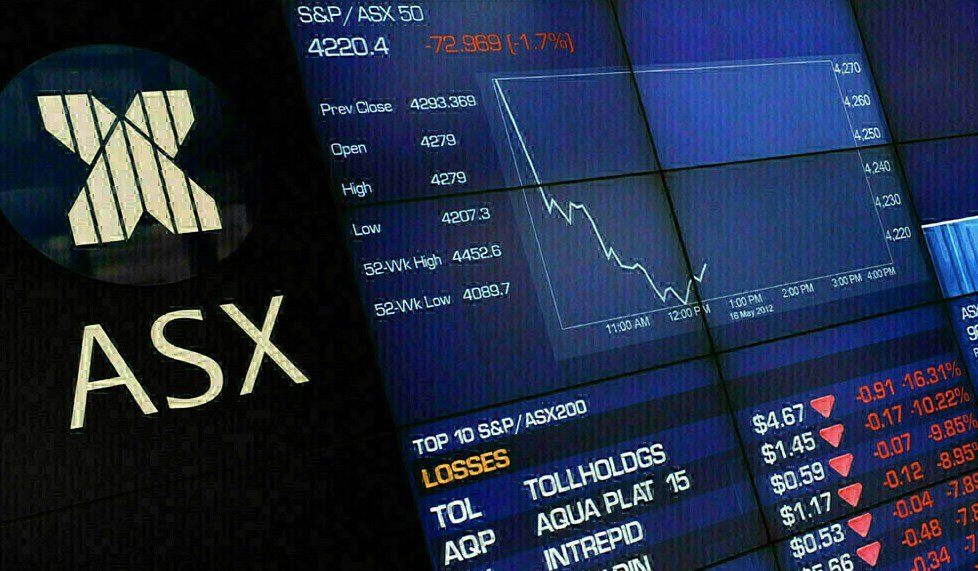

The S&P/ASX 200 index fell 0.2% to 7,040.20 by 1130 GMT after a 1.4% gain last week. Minutes of the Reserve Bank of Australia’s (RBA) October meeting, due on Tuesday, will be closely assessed by investors for clues into where interest rates will stand going forward.

The September unemployment report due on Thursday is expected to play a key role in the RBA’s monetary policy decision next month. “A tight labour market may strengthen the odds for the RBA to continue raising interest rates,” said Tina Teng, a markets analyst at CMC Markets.

Tech stocks drop the most

Tech stocks dropped the most on the benchmark index, with a 2.3% fall. Megaport and Xero dropped 1.9% and 2.6%, respectively.

The sector was weighed down by a sell-off in US tech stocks on Friday, as investors worried about rising bond yields and inflation pressures. The Nasdaq Composite index fell 1.1%, while the S&P 500 technology sector declined 1.4%.

Financials also fall

Heavyweight financial stocks declined 0.6%, with the “big four” banks down between 0.4% and 0.9%.

Westpac tapped Ampol chairman Steven Gregg to take over as chairman, replacing veteran banker John McFarlane who will complete his term on Dec. 14. Westpac shares were down 0.9%.

The banking sector also faced pressure from rising bond yields, which could hurt their net interest margins and profitability.

Gold stocks jump

Gold stocks jumped 4.7%, hitting their highest level since Sept. 18, after safe-haven bullion rallied more than 3% on Friday over the Middle East conflict. Newcrest Mining, the country’s largest gold miner, gained about 4.4%.

Gold prices rose as investors sought refuge from geopolitical tensions and inflation worries. Israel launched air strikes on Gaza on Friday, while Iran said it would resume nuclear talks with world powers next week.

Energy stocks advance

Energy stocks advanced 0.9% on concerns the Middle East conflict could drive up oil prices further. Santos and Woodside Energy were up 1.6% and 1%, respectively.

Oil prices rose to their highest levels in seven years on Friday, as supply disruptions and strong demand boosted the market. Brent crude futures settled at $85.43 a barrel, while US West Texas Intermediate (WTI) crude futures ended at $82.28 a barrel.