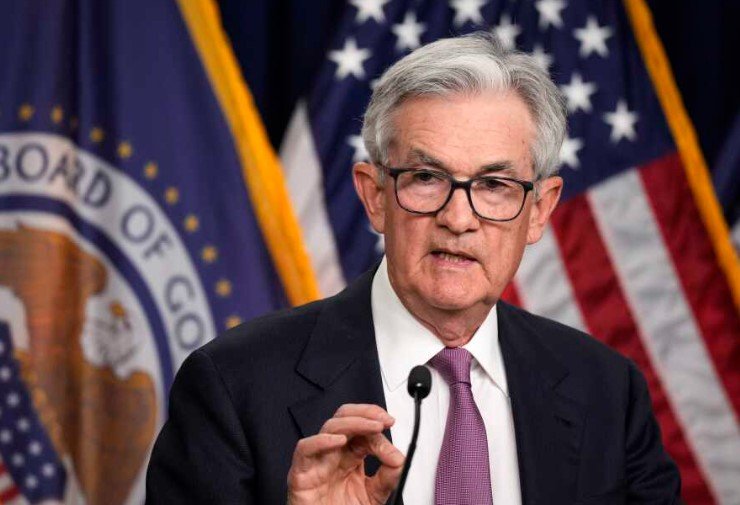

The Federal Reserve lowered its key interest rate by a quarter point on October 29, 2025, bringing the target range to 3.75 percent to 4.00 percent. This move, led by Chair Jerome Powell, aims to support a cooling job market while keeping an eye on sticky inflation amid economic uncertainties.

Rate Cut Details and Voting Breakdown

Federal Reserve officials made the decision during their two day Federal Open Market Committee meeting in Washington. The cut marks the second reduction this year, following a similar action in September.

Ten out of twelve committee members supported the 25 basis point cut. One member pushed for a larger 50 basis point drop, while another wanted rates to stay the same.

This adjustment reflects the Feds effort to balance risks in a shifting economy. Officials noted that job growth has slowed, with unemployment risks on the rise.

The policy statement highlighted ongoing moderate economic expansion. Yet inflation remains above the central banks 2 percent target, creating caution for future moves.

Powells Comments on Future Rate Path

In his press conference after the announcement, Jerome Powell stressed that decisions depend on incoming data. He made it clear that a December rate cut is not guaranteed.

Powell pointed to uncertainties from a recent government shutdown. This event has delayed key economic reports, making it harder to assess the situation.

He described the cut as a risk management step. The Fed wants to protect the labor market without letting inflation rebound.

Market reactions showed some disappointment. Stocks dipped slightly as investors adjusted expectations for more easing soon.

Analysts now see about a 60 percent chance of another cut in December. This is down from higher odds before the meeting.

Economic Outlook and Projections

The Fed updated its economic forecasts alongside the rate decision. Officials expect unemployment to reach 4.5 percent by the end of 2025.

Inflation projections show core prices rising at 3 percent this year. That is higher than earlier estimates, signaling persistent pressures.

Growth is projected to continue at a moderate pace. The economy expanded at an annual rate of 2.8 percent in the third quarter.

Here are some key economic indicators from recent data:

- Unemployment rate: Currently at 4.1 percent, up from last year.

- Inflation rate: Core PCE at 2.7 percent, still above target.

- Job gains: Averaged 29,000 per month recently, a sharp slowdown.

These figures underline the Feds cautious approach. Powell noted that without full data, rushing more cuts could be risky.

Impact on Markets and Consumers

Wall Street responded with mixed signals. The Dow Jones, Nasdaq, and S&P 500 each fell nearly 1 percent after the announcement.

Bond yields rose slightly, reflecting doubts about further easing. The dollar strengthened against other currencies.

For everyday Americans, lower rates could mean cheaper loans soon. Mortgage rates have already started to decline from recent highs.

| Sector | Potential Impact |

|---|---|

| Housing | Lower mortgage rates may boost home buying. |

| Stocks | Volatility expected as rate path remains unclear. |

| Jobs | Aims to prevent further labor market weakening. |

| Inflation | Risk of resurgence if cuts go too far. |

Businesses might see easier borrowing for expansion. However, savers could earn less on deposits.

Global markets felt the ripple effects. Asian and European indexes traded lower in response.

Broader Context and Policy Shifts

This rate cut fits into a broader easing cycle that began after a period of hikes. The Fed had raised rates aggressively in 2022 and 2023 to fight inflation.

Now, with inflation cooling but not defeated, the focus shifts to employment. Powell acknowledged internal debates within the committee.

Recent events like trade tensions and fiscal policies add complexity. For instance, potential tariffs under new leadership could influence inflation.

The Fed also plans to adjust its balance sheet runoff. Starting in December, it will reinvest some maturing securities into Treasury bills.

This change signals an end to quantitative tightening. It could provide more liquidity to financial markets.

Experts say these moves show the Feds adaptability. Yet challenges remain, including divided views among policymakers.

What do you think about the Feds latest decision? Share your thoughts in the comments below and pass this article along to friends interested in economic news.