A Critical Week for Asia: Xi’s Diplomatic Push, Economic Data, and Corporate Earnings

Asia is set for a week of high-stakes political, economic, and corporate developments. Chinese President Xi Jinping is embarking on a significant diplomatic tour through Southeast Asia, while key economic reports will shed light on regional growth concerns. Investors are also keen on Taiwan Semiconductor Manufacturing Company’s (TSMC) earnings, which could signal broader trends in the tech sector.

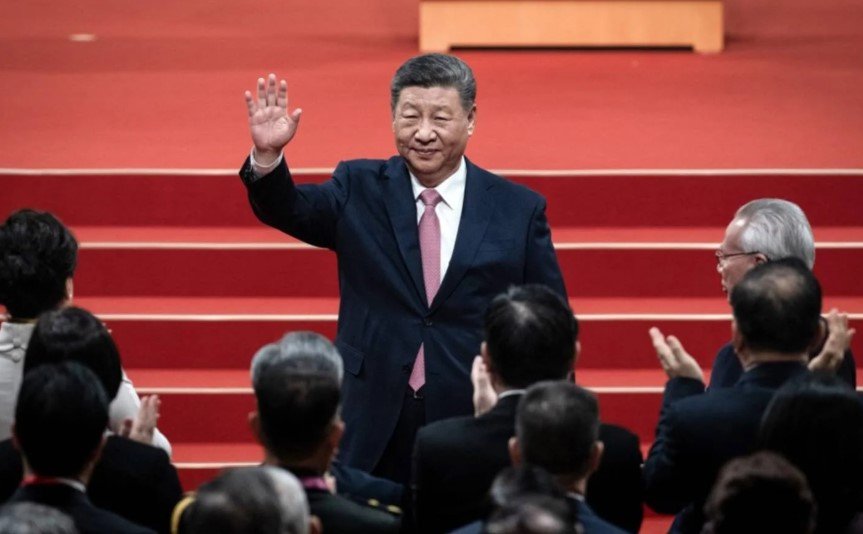

Xi Jinping’s Southeast Asia Tour

Chinese President Xi’s visit to Vietnam, Malaysia, and Cambodia is more than just a diplomatic mission—it’s a critical engagement as the region grapples with the economic consequences of President Trump’s recent trade tariffs. As the U.S. imposes tariffs on numerous goods, Southeast Asia is facing both economic challenges and opportunities.

The countries Xi is visiting—Vietnam and Cambodia, in particular—are among the hardest-hit by the U.S. trade measures. Xi’s visit comes at a time when China is under pressure to stabilize its economic growth and maintain influence in the region. Vietnam, Cambodia, and Malaysia are all key players in ASEAN, and China’s relationships with them have been pivotal for its Belt and Road Initiative.

As Vietnam and Cambodia look to bolster their manufacturing sectors amidst shifting trade dynamics, Xi’s diplomacy could play a key role in reassuring these countries of China’s continued commitment to regional trade and investment. Meanwhile, Malaysia, as this year’s ASEAN chair, will have a unique position to lead discussions on trade and economic cooperation within the bloc, especially in response to Washington’s tariff moves.

Xi’s Southeast Asia tour is seen as a strategic outreach, reinforcing China’s leadership in the region. Expect major discussions surrounding trade, infrastructure, and regional security. In the backdrop, these diplomatic overtures come amid increased scrutiny of China’s influence in Southeast Asia.

Singapore’s Monetary Policy Decision

On the economic front, Singapore will announce its latest monetary policy decision this week, with analysts closely watching for any signs of a shift in the city-state’s approach to inflation and economic growth.

Singapore’s monetary policy is uniquely linked to its currency, with the Monetary Authority of Singapore (MAS) adjusting its nominal effective exchange rate to influence inflation. As the global economy faces concerns over stagflation, any changes to the monetary policy stance could signal a response to these inflationary pressures or a pivot toward more aggressive tightening.

The MAS has been relatively cautious in recent years, but with inflationary concerns rising, this decision will likely be critical for investors watching the broader ASEAN region for signals on how central banks might respond to global inflation.

TSMC Earnings and Tech Sector Outlook

Turning to the corporate world, Taiwan Semiconductor Manufacturing Company (TSMC), a global tech leader, will report its earnings this week. TSMC’s performance is seen as a barometer for the broader semiconductor industry, which has been under pressure due to global supply chain issues and shifting demand from major markets like the U.S., China, and Europe.

Key Insights to Watch For:

-

Demand for Chips: Investors will be focused on TSMC’s outlook for chip demand, especially as the U.S. and China continue their trade tensions and technology decoupling. TSMC has remained resilient despite geopolitical challenges, but it is unclear whether this trend will hold.

-

Impact of Trade Tariffs: Given that the semiconductor industry is at the heart of the U.S.-China rivalry, any insights into how trade policies are affecting TSMC’s operations in China and other key markets will be closely scrutinized.

-

Supply Chain and Production Challenges: With the global semiconductor supply chain still recovering from disruptions, TSMC’s insights into its production capacity and any potential impacts from U.S. or Chinese policies will be key drivers for the tech sector’s performance moving forward.

Economic Data to Watch

In addition to these high-profile events, the week will also bring critical economic data for investors to digest. China is set to release its latest GDP figures, which will provide insight into the country’s economic health amid ongoing global uncertainties. With concerns over stagflation mounting, these figures will likely be a focal point for those assessing China’s recovery post-pandemic.

Meanwhile, Japan will share its consumer price index data, another crucial report that will inform the Bank of Japan’s next move on interest rates. As inflationary pressures increase globally, Japan’s central bank faces tough decisions on whether to raise interest rates, something that hasn’t been seen in decades. The consumer price data will provide vital clues on whether Japan can continue its ultra-loose monetary policy or if a shift toward tightening is in the cards.