Silver prices jumped sharply on Friday, breaking into record territory as investors piled into precious metals amid tight supply, heavy industrial use and a broader rally sweeping commodities. The move capped a volatile week and underscored how quickly sentiment has shifted in metals markets.

The white metal climbed as much as 9%, touching an all-time high of $78.53 an ounce, according to data cited by Reuters. Gold and platinum followed close behind, each setting fresh records of their own.

A sudden price jump that caught traders off guard

The scale of silver’s move surprised even seasoned traders. A 9% single-day rise is rare for a metal that often lags gold in headline moves.

Prices pushed higher through the Asian and European sessions, gaining momentum as liquidity thinned. By the time U.S. markets came into focus, silver was already trading at levels that would have seemed ambitious just weeks ago.

Some desks described the rally as “crowded but justified.” That sounds contradictory, but it fits. Investors have been talking about silver’s tight supply for months. What changed was timing.

A wave of buying hit all at once.

Gold rose alongside silver, hitting a record $4,549.71 an ounce. Platinum jumped more than 10% to $2,454.12 an ounce, also a historic high. Palladium lagged, but still gained ground.

It felt like a broad metals moment, not just a silver story.

The deficit problem that refuses to go away

Behind the price action sits a stubborn imbalance. Global silver supply has struggled to keep up with demand for several years, and 2025 has done little to ease the strain.

Mine output has been uneven, with disruptions in Latin America and lower grades weighing on production. Recycling, often a swing factor, has failed to pick up meaningfully, even with prices pushing higher.

That leaves inventories thinner than many expected.

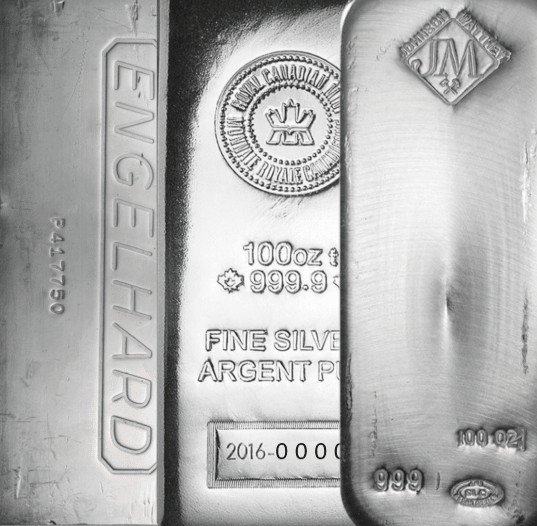

Analysts tracking physical flows point to shrinking above-ground stocks, especially in Asia. Bars and coins are moving, but so is silver tied up in long-term industrial contracts.

Basically, there’s less slack in the system.

A senior metals analyst at a European bank summed it up this way: the market can tolerate a deficit for a while, until it suddenly can’t. Then prices jump, fast.

That appears to be where silver is right now.

Industry demand adds fuel to the rally

Unlike gold, silver wears two hats. It’s a financial asset and a workhorse metal.

Industrial demand has been a major driver this year, particularly from:

-

Solar panel manufacturing

-

Electric vehicle components

-

Electronics and data infrastructure

Solar alone has become a huge sink for silver. Each new installation uses small amounts, but at massive scale. Those ounces don’t come back quickly, if ever.

Electronics demand has also held firm, even as some tech sectors slowed. High-performance chips, sensors and power systems still rely on silver’s conductivity.

Here’s a snapshot of how silver demand breaks down, based on industry estimates:

| Demand Segment | Approx. Share |

|---|---|

| Industrial use | ~55% |

| Jewelry & silverware | ~25% |

| Investment | ~20% |

That heavy industrial weighting makes silver more sensitive to real-economy trends than gold. When factories hum, silver feels it.

And right now, factories are still humming in key regions.

Safe havens, speculation and a crowded trade

Silver’s rally hasn’t been purely about fundamentals. Investor psychology is playing a role.

With geopolitical risks lingering and interest rate expectations shifting, precious metals have regained their shine as stores of value. Gold usually gets first dibs. Silver often follows, then overshoots.

That pattern showed up again this week.

Futures positioning data suggest speculative interest has risen quickly. Exchange-traded products backed by silver have also seen inflows, reversing months of hesitation.

Some traders admit the trade is getting busy. When everyone leans the same way, reversals can be sharp.

Still, others argue silver remains under-owned relative to gold. On a historical ratio basis, silver looks expensive compared to its own past, but still cheap next to gold’s surge.

That debate is likely to intensify.

One thing is clear: volatility is back.

What comes next for precious metals markets

The key question now is whether silver can hold these levels.

Physical demand will matter. If industrial buyers step back, even briefly, prices could cool. If they keep buying, the floor may be higher than expected.

Macroeconomic signals also loom large. Any surprise shift in interest rate outlooks, currency moves, or growth data could ripple through metals.

Gold’s record run offers some support. Platinum’s breakout adds confirmation that this isn’t a one-metal story.

But silver, famously moody, may yet test investors’ nerves.

For now, the metal is enjoying its moment in the spotlight. Traders, manufacturers and policymakers alike are watching closely, because when silver moves like this, it usually means something bigger is brewing beneath the surface.