Goldman Sachs announces sale of GreenSky platform and loan assets

Goldman Sachs Group Inc. has agreed to sell its GreenSky unit, a fintech platform for home improvement consumer loan originations, to a consortium of institutional investors led by Sixth Street Partners, a global investment firm. The deal, which is expected to close in the first quarter of 2024, is valued at approximately $2.24 billion and will be paid in stock. The New York Times reported that the transaction will result in a 19-cent-per-share hit to Goldman Sachs’ third-quarter earnings.

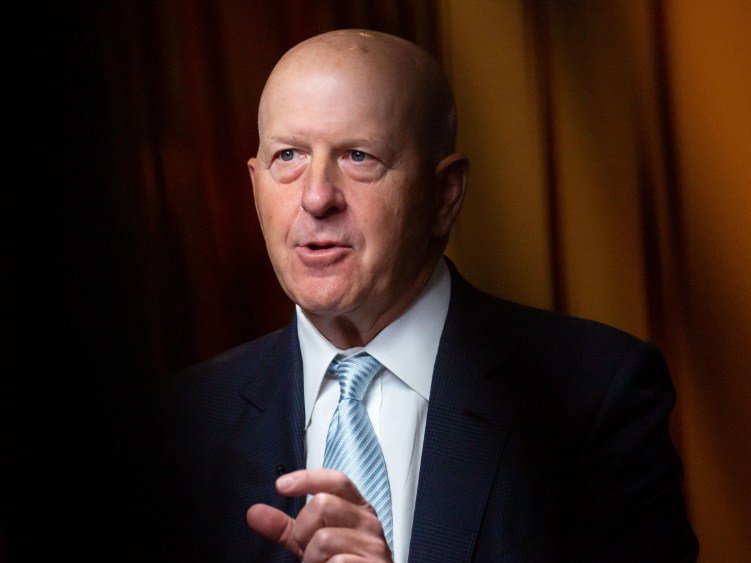

Goldman Sachs acquired GreenSky for $2.24 billion in September 2021, with the intention of integrating its capabilities into its Marcus banking app. However, the bank decided to sell the unit as part of its strategy to narrow the focus of its consumer business and drive higher, more durable returns. David Solomon, Chairman and CEO of Goldman Sachs, said that “while GreenSky is an attractive business, we are focused on advancing the strategy we laid out for our two core franchises.”

GreenSky offers innovative payment solutions for merchants and consumers

GreenSky was founded in 2006 and has since become the largest fintech platform for home improvement financing solutions. The company provides simple and transparent loans for consumers who want to renovate their homes, and helps merchants accelerate their business by offering payment options at the point of sale. GreenSky has a network of over 10,000 merchants and has served approximately four million customers.

The company operates a cloud-native platform that connects borrowers, merchants, and banks in real time. GreenSky leverages its proprietary technology and data analytics to offer instant credit decisions, flexible loan terms, and paperless processes. The company also benefits from a low-cost funding model, as it does not hold loans on its balance sheet but transfers them to partner banks.

Sixth Street leads consortium to acquire GreenSky and support its growth

The consortium acquiring GreenSky is led by Sixth Street, a global investment firm with over $60 billion in assets under management. The consortium also consists of funds and accounts managed by KKR, Bayview Asset Management, and CardWorks. In addition, PIMCO will provide significant support through an asset acquisition, and CPP Investments will provide strategic financing.

The consortium plans to continue GreenSky’s legacy of driving growth through enhanced technology and great user experiences. Alan Waxman, Co-Founder and CEO of Sixth Street, said that “GreenSky accelerates business growth for its network of home improvement merchants by delivering innovative payment solutions at the point of sale, and we plan to continue the company’s legacy of driving growth through enhanced technology and great user experiences.”

David Zalik, CEO of GreenSky, expressed his excitement about joining Goldman Sachs and said that “in combination with Goldman Sachs, we’re excited to continue delivering innovative point-of-sale payment solutions for our merchant partners and their customers on an accelerated basis.”