The bill aims to protect banks that serve cannabis businesses

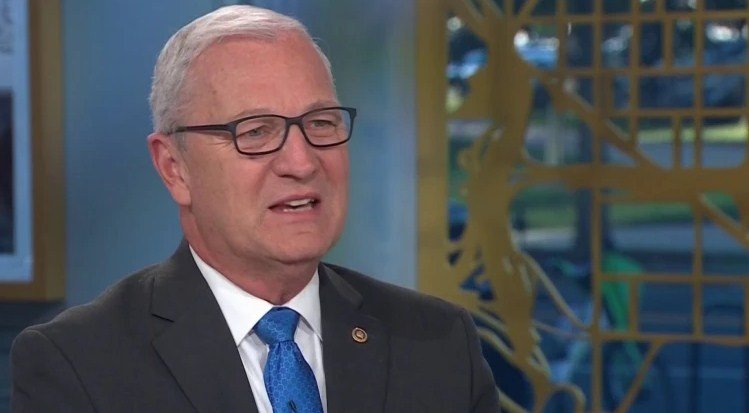

Sen. Kevin Cramer (R-N.D.) has expressed his support for a bill that would provide legal protection for banks that work with marijuana businesses in states where cannabis is legal. The bill, known as the Secure and Fair Enforcement (SAFE) Banking Act, was passed by the House of Representatives last week and is awaiting action in the Senate.

Cramer, who is a co-sponsor of the bill, said that the legislation would help to put some “parameters around the industry” and prevent money laundering and other criminal activities. He also said that the bill would respect the rights of states to decide their own policies on marijuana.

“The SAFE Banking Act is not a pro-cannabis bill, it’s a pro-banking bill,” Cramer said in an interview with NBC News on Sunday. “It’s a pro-states’ rights bill. It’s a pro-public safety bill.”

Currently, most banks are reluctant to serve cannabis businesses because marijuana is still illegal at the federal level. This forces many cannabis businesses to operate on a cash-only basis, which poses security risks and makes it harder to track their transactions and taxes.

The SAFE Banking Act would prevent federal regulators from penalizing banks that provide services to legitimate cannabis businesses. It would also allow banks to access the Federal Reserve system and offer credit cards, loans, and other financial products to the cannabis industry.

The bill faces opposition from some Republicans and anti-marijuana groups

The SAFE Banking Act has bipartisan support in both chambers of Congress, but it also faces opposition from some Republicans and anti-marijuana groups who argue that it would enable the expansion of the cannabis industry and undermine federal drug laws.

Sen. Mike Crapo (R-Idaho), the chairman of the Senate Banking Committee, has said that he does not support the bill in its current form and that he wants to see more changes to address public health and safety concerns. He has also suggested that the bill should be tied to broader legislation that would reform federal marijuana laws.

Some anti-marijuana groups, such as Smart Approaches to Marijuana (SAM), have also criticized the bill as a “Trojan horse” that would pave the way for full legalization of marijuana at the federal level. They claim that the bill would benefit large corporations and Wall Street investors at the expense of public health and social justice.

“The SAFE Banking Act is a dangerous bill that would reward the marijuana industry with access to Wall Street’s deep pockets,” SAM President Kevin Sabet said in a statement. “This would allow Big Marijuana to expand its operations and market its addictive and harmful products to more Americans.”

The bill reflects the changing attitudes toward marijuana in the U.S.

The SAFE Banking Act reflects the changing attitudes toward marijuana in the U.S., where more than two-thirds of Americans support legalizing cannabis for medical or recreational use, according to a recent Gallup poll. So far, 36 states and four territories have legalized medical marijuana, while 18 states, two territories, and Washington, D.C., have legalized recreational marijuana.

However, marijuana remains a Schedule I substance under the Controlled Substances Act, which means that it has no accepted medical use and a high potential for abuse. This creates a conflict between state and federal laws that complicates the regulation and taxation of the cannabis industry.

The SAFE Banking Act is one of several bills that have been introduced in Congress to address this issue. Another bill, known as the Marijuana Opportunity Reinvestment and Expungement (MORE) Act, would remove marijuana from the Controlled Substances Act and expunge past convictions for marijuana offenses. The MORE Act was also passed by the House last week, but it faces an even steeper challenge in the Senate.

Cramer said that he supports rescheduling marijuana to a lower category of drugs, but he does not favor full legalization or expungement. He said that he believes that states should have the final say on how to regulate marijuana within their borders.

“I think we ought to let states decide this issue,” Cramer said. “And if they decide to legalize it, then we ought to have some banking regulations around it.”