According to a recent survey by Bankrate, Montana is one of the states with the highest percentage of residents who still use brick-and-mortar banks, above the national average of 76.8%. The survey found that 81.8% of Montana residents have visited a bank branch in the past year, compared to only 18.2% who have not. The survey also revealed some of the reasons why Montanans prefer traditional banking over online options.

Convenience and Trust Are Key Factors for Montanans

One of the main reasons why Montanans choose to visit bank branches is convenience. Many rural areas in Montana lack reliable internet access or mobile coverage, making online banking difficult or impossible. Moreover, some banking services, such as depositing cash or getting a cashier’s check, can only be done at a physical location. For many Montanans, visiting a bank branch is also a way to support their local community and economy.

Another factor that influences Montanans’ banking preferences is trust. Many Montanans are wary of online fraud, identity theft, or cyberattacks that could compromise their financial security. They feel more comfortable dealing with real people who know them personally and can offer personalized advice and assistance. They also value the human interaction and social connection that comes with visiting a bank branch.

Online Banking Has Its Advantages But Also Challenges

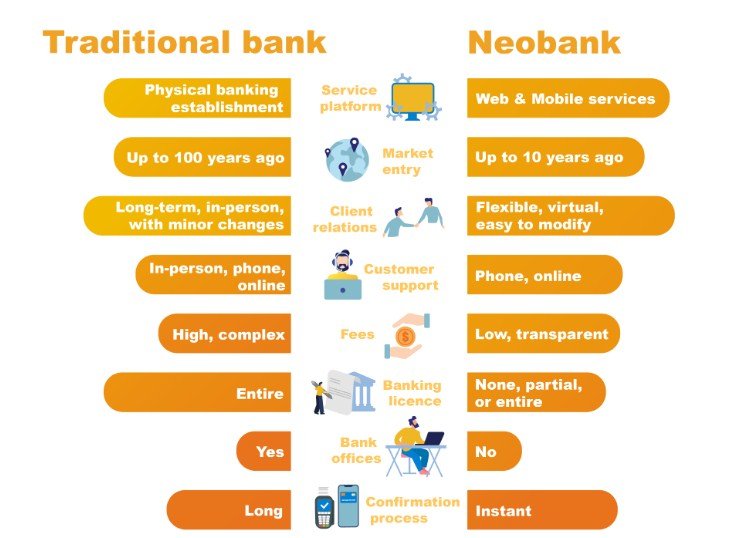

While brick-and-mortar banking remains popular in Montana, online banking has its own advantages that could appeal to some customers. Online banking offers convenience, speed, and accessibility for those who have reliable internet access and mobile devices. It also allows customers to compare different products and services from various providers and find the best deals. Online banking can also help customers save money on fees, interest rates, and other charges that traditional banks may impose.

However, online banking also faces some challenges that could deter some customers from using it. One of the challenges is customer service. Online banking customers may have to deal with automated systems, chatbots, or call centers that may not be able to resolve their issues or answer their questions satisfactorily. Another challenge is security. Online banking customers need to be vigilant about protecting their passwords, personal information, and devices from hackers, scammers, or malware. They also need to be aware of the terms and conditions of their online accounts and the risks involved in using them.

Montana Residents Have Diverse Banking Needs and Preferences

The survey by Bankrate shows that Montana residents have diverse banking needs and preferences that depend on various factors such as location, income, age, lifestyle, and personal values. While brick-and-mortar banking remains dominant in Montana, online banking could also gain more popularity as technology improves and customer demand increases. Ultimately, Montana residents need to weigh the pros and cons of each option and choose the one that suits their needs and preferences best.