A systematic approach to the China theme

The new fund, named Aspect China Diversified Fund, will use the firm’s systematic medium-term trend-following models to trade more than 40 onshore Chinese futures markets across six asset classes: agriculturals, bonds, energies, industrials, metals and stock indices.

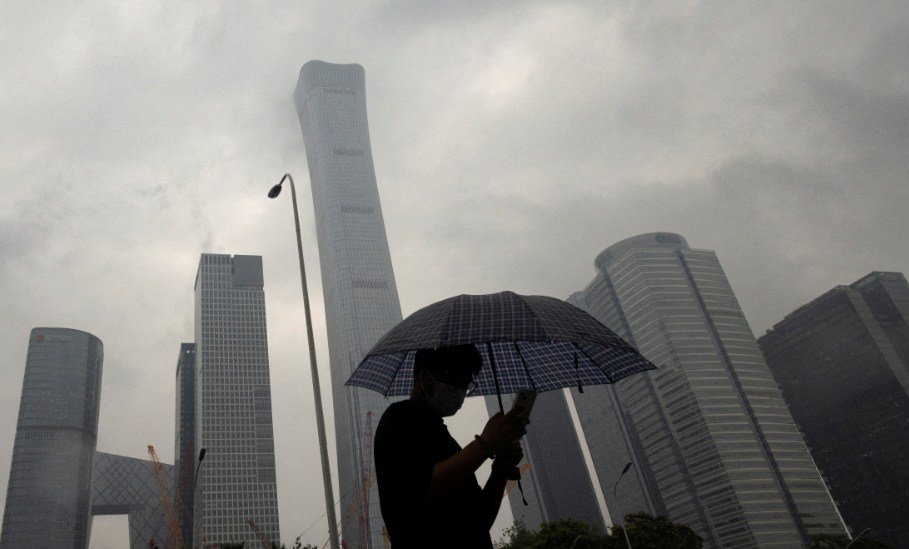

The fund will aim to provide systematic access to the ‘China theme’ – the second biggest economy in the world – and offer low correlations to traditional assets and global commodity markets, offering strong diversification potential. The fund will also target attractive set of new and liquid commodity markets that could provide possible inflation-hedging properties.

The fund will launch with more than USD100 million in external capital and offer weekly liquidity with an annualised volatility of 15 per cent.

Leveraging extensive research and experience

Aspect Capital is one of the leading firms in the field of quantitative hedge fund and CTA, with more than USD9.3 billion in assets under management across a range of systematic hedge fund strategies, spanning managed futures, multi-strategy, alternative risk premia, and currencies.

The firm was established in 1997 by Anthony Todd and Martin Lueck, who earlier ran CTA pioneer AHL – which is now part of Man Group.

The firm has been researching and applying systematic investment models to onshore Chinese futures markets since 2012, and has been accessing them in conjunction with an onshore partner since 2016.

“We are excited to be able to leverage this research, and five years’ experience in applying systematic investment models to onshore Chinese futures markets, to provide investors with this compelling opportunity to access a new, uncorrelated, diversifying return stream,” said Aspect CEO and co-founder Anthony Todd.

Capitalising on growing investor demand

The launch of the new fund comes at a time when global investors are increasingly looking for new opportunities in China, as the country’s economy continues to grow and open up to foreign participation.

China’s futures markets have also seen rapid development and expansion in recent years, with more products, participants and liquidity, making them more attractive and accessible for systematic investors.

“With uncertainty over the sustainability of current equity market valuations, declining bond yields and the looming threat of inflation, we believe now is an interesting time for investors to consider adding exposure to Chinese financial and commodity futures markets to their portfolios,” Todd added.

The new fund will join Aspect’s existing suite of products, which include the Aspect Core Diversified Programme, a medium-term quantitative trend-following strategy that trades more than 100 liquid financial and commodity markets, and the Aspect Alternative Risk Premia Programme, a multi-asset, multi-style strategy that aims to capture a diversified set of risk premia across equities, fixed income, currencies and commodities.